2021 Deltek Vantagepoint & Vision Year-End Advice

2021 year-end is rapidly approaching, and it is vital to begin your year-end processes to ensure a timely close. For some finance and accounting professionals, the year-end process can be a struggle and a daunting endeavor. However, Deltek Vantagepoint and Vision clients can breathe a sigh of relief with some handy suggestions.

Below are some recommended areas and process to be sure to review to help complete a thorough year-end close. It is also recommended to develop deadlines for each area prior to opening the new year to help stay on track and minimize the stress around wrapping up year end.

Create a Year-End Checklist

The first step in the year-end process is to develop a personal list of processes by noting all modules owned in the system and compiling information from Deltek Vantagepoint or Vision as well. It is also wise to review the weekly and monthly deadlines in the checklists to be sure all items have been completed.

Additionally, be sure to visit the year-end info center in the Deltek Customer Care Portal. Here, Deltek clients can gather checklists and step-by-step procedures for getting Vantagepoint or Vision ready to close out the year and begin a new year. This is updated yearly and is an invaluable source of information for the necessary processes based on the modules owned by each firm.

Year-End Process Considerations

In addition to the items and recommendations found in the Deltek Customer Care Portal, outlined below are some standard tasks to complete when preparing for year-end.

- Enter and complete posting of all 2021 transactions.

- Review the fiscal year checklist prior to completing the calendar year closeout.

- Complete all cash account and bank reconciliations and verify that the reconciled GL matches the GL balance.

- Review and complete all credit card reconciliations. This will require getting the expenses into the expense reports and posted in the year they happened - this is important for both reconciliation and for invoicing.

- Run the file reconciliation report and troubleshoot as well as correct any differences. Review the profit and lost statement and balance sheet to verify proper categorization in accounts.

- Run the unposted labor report and address any timesheets that require posting. Complete an interactive billing cleanup of any outstanding WIP that will not be invoiced, or that has been invoiced and not removed from the billing module by marking to be deleted and accepting a zero-dollar invoice.

- Make any projects dormant that are no longer active.

- Be sure to review all terminated employees for a termination date and setting the admin level for timesheet and expense reports to staff. Review all active employees and set valid company domain email addresses, hours per day, and timesheet and expense admin levels.

- Evaluate the 2021 budgets to determine if 2021 goals were met. Set goals for 2022 and gather GL budget information that needs to be entered into the system.

- Set up new holidays for the upcoming year in the holiday configuration/settings. This allows the timesheet to show the new holidays as well as for the utilization ratios to correctly calculate each year.

- Review employee vacation time reporting to send out notifications needed for employees who may lose vacation time in the cut over to the new year. Now is a good time to have employees decide what to do with approaching maxes, limits, and upcoming vacations.

- Collect on past due invoices!

- Pay all vendors due to be paid and initialize the 1099 process before opening a new year. Void outstanding checks that may have expired. Make sure to order 1099 preprinted forms NOW before it’s too late.

- Save all audit reports as PDFs for info center/hub changes.

Close Out 2021 with Deltek Vantagepoint and Vision

Following the recommended steps by Deltek and trusted consultants, year-end should not only run in a timely manner, but can also run smoothly and with less stress for Vantagepoint and Vision clients. Developing a good process flow now makes each following year even smoother and allows some of the process to be delegated out with confidence that is will be completed in timely manner year after year. Help is just a click away! Use the image button below to find year-end resources available from Deltek.

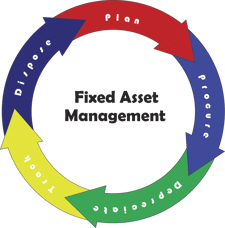

Professional service firms don’t traditionally sell products; rather they sell their time and expertise. Increasingly, they ARE selling products and time, and are spending a great deal of capital on tools to deliver both.

Professional service firms don’t traditionally sell products; rather they sell their time and expertise. Increasingly, they ARE selling products and time, and are spending a great deal of capital on tools to deliver both.