Top 6 Financial Performance Metrics to Monitor for a Healthy Business

As an executive in a professional services firm, you have many demands on your time. Many times you are pulled into client conferences, HR issues, and day-to-day “how-to” decisions. With all the distractions, how do you continue to monitor your business health? There is a plethora of financial performance metrics to help you monitor your company’s financial health.

Most financial performance metrics are “lagging indicators”, with the exception of the backlog. Meaning that they are a great indicator of how you performed (past tense). Unfortunately, you can’t control or affect change. The benefit of tracking lagging metrics is that it gives you the ability to change course to impact the future. Since lagging indicators are based on actual performance, even if you haven’t been tracking these metrics, it is pretty easy to go back and get the information (accounting people everyone now hate me). In an upcoming article, we will discuss leading metrics. These metrics help your firm know where you are going therefore allowing you time to change course.

When reviewing your financial performance metrics, it is important to understand how other firms in your industry compare. If you consistently have a 3.00 direct labor multiplier, that may be good – and you may be profitable, but if everyone else in your industry consistently has a 3.75 multiplier, that would tell you that you need to review your bill rate structure. Perhaps you can do even better in profits! Several companies (PSMJ comes to mind) queries companies and publish trends on financial metrics. Check out our past article: The Business Benchmarking Process: 4 Key Steps on this topic.

There isn’t one metric that is the “magic bullet” of reporting your company’s health (sorry to say). Profit will tell you if you “made money” – right? But it doesn’t tell you how you made that money and where your weaknesses are.

Here are two examples to help illustrate:

- Your production staff may have a 95% utilization (i.e. 95% of the time at work is spent on production projects), but if you do not have an effective multiplier high enough to cover your indirect and overhead expenses – that utilization will not translate into profits.

- Your profits can be soaring but if the days your Accounts Receivable is outstanding is growing, you are not translating your profits into cash.

Using a combination of metrics identified below can help determine if your firm is making money, but equally important, how you are making the money.

- Profit – Well duh you say, however, you would be surprised at the number of business owners that watch their profit numbers dwindle while making excuses or “hoping” it will simply turn around. Your profit is your way of ensuring that your revenues are exceeding your costs. While one month of poor profit performance should not send you to the stratosphere of worry, a two to three months trend of poor performance should start you down the path of inquiry as to the cause and solutions. Profits are tracked both as an amount and as a percentage of your revenues.

- Cash Flow – Cash is king as they say! Profit on an accrual basis is a nice indicator of the work your staff has performed, but if it never translates into cash then you really are not ahead of the game. If you are not collecting on your billings, then you aren’t really making money – regardless of what your financials say. Cash inflow is what supports your ability to pay your bills – including your employees – timely. Again, if you have one month of poor cash flow, then you probably don’t need to get too excited, but when you see this beginning to trend downward then you need to research.

- Average Days outstanding – This is the indicator that you are collecting on what you bill which directly affects cash flow. So if your profit is looking good, but your cash flow isn’t, this might be a good place to start looking. As your AR ages, you are not putting that money back into your cash flow – keeping in mind you have typically already paid your employees. Clients that usually pay on-time do not suddenly start paying late for no reason. When your average days outstanding begins to grow, this could be indicative of your clients perceived service quality had decreased. It is in your best interest to identify this issue and correct it immediately.

- Utilization – For professional services firms, what you sell is your employee’s time. So it is important to keep tabs on what your staff is doing. If this number is steadily decreasing, then you can bet your profits are also decreasing. This number is affected by the amount of non-production work that is being assigned to production staff. If your production staff have billable work to do, and have also been assigned high priority non-production work, then utilization can be affected in the short term. However, as soon as the non-production work is complete, it should fall back into line. If however, your staff is doing non-production work because they do not have production work to do that is also whole different story. Anytime your utilization slips, it is worth an inquiry as to the reason and the finding a resolution.

- Effective Multiplier – This is the ratio of your net revenue divided by your direct labor costs. This lets you know how much money in revenue (and hopefully cash inflow) you can expect for every dollar of direct labor you spend. This multiplier affects your ability to cover your indirect and overhead costs as well as meet profit goals. This ratio can be a reasonable number, but if you do not have enough hours utilized on production projects, you may still not be profitable.

- Annual Net Revenue in Backlog – Backlog is the dollar value (expressed as net revenue) you have contracted for, but not yet performed. When you create a ratio of backlog over your 12 month net revenue, you can use that ratio to calculate how many days work you have under contract. This is a forward-looking metric and the only one mentioned that looks to the future. Focusing strictly on past financial performance won’t prepare your firm for if there is a downturn looming (i.e. low backlog) or more work than your existing staff can handle.

Remember, each of the metrics above is just one piece of the puzzle to your firm’s financial health. You can’t take just one as your company gospel. They are interrelated and play on each other.

Financial performance metrics are typically calculated monthly and reviewed. However, they can also be reported only a quarterly basis. Sometimes, people decide based on how things are trending. If your metrics are trending up then focus on them quarterly. If your metrics are instead trending downward then switch to monthly. Work with your accounting staff to have these metric prepared for the past several months/years allows you to get an idea of past performance and decide how often you need to review.

As you get to know the above metrics and understand their interrelation you will be able to quickly identify when your company is going ‘sideways’ and understand the action needed to adjust your course accordingly. Check out this past webinar to see how your firm can become ‘Best In Class’.

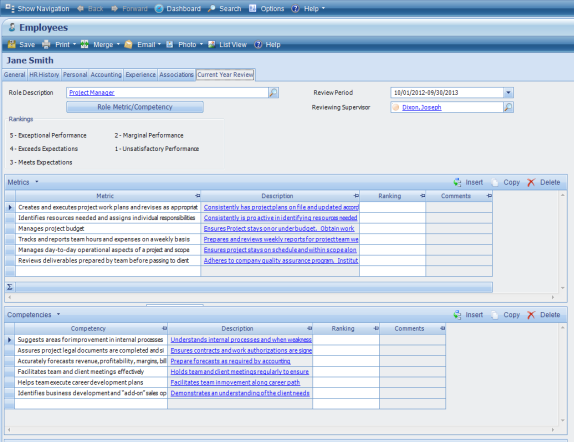

In order to truly gain a holistic view of the organization, there are key financial ratios and indicators that project-based firms should focus upon at regular intervals. Some key project performance metrics need to be monitored on a real-time basis, or at least weekly, while others are more relevant on a monthly basis. Also, because firms must first win projects and engage in other activities that do not directly produce revenue, project-based firms should also regularly monitor firm-wide metrics.

In order to truly gain a holistic view of the organization, there are key financial ratios and indicators that project-based firms should focus upon at regular intervals. Some key project performance metrics need to be monitored on a real-time basis, or at least weekly, while others are more relevant on a monthly basis. Also, because firms must first win projects and engage in other activities that do not directly produce revenue, project-based firms should also regularly monitor firm-wide metrics.

I was talking recently with a prospective client who observed that his firm had outgrown QuickBooks (QB). The conversation eventually led to a discussion of the advantages of ERP systems over back office accounting systems — which include not only efficiency gains, but strategic improvements as well.

I was talking recently with a prospective client who observed that his firm had outgrown QuickBooks (QB). The conversation eventually led to a discussion of the advantages of ERP systems over back office accounting systems — which include not only efficiency gains, but strategic improvements as well.

ERP – Enterprise Resource Planning is a system facilitating the flow of information between all business functions, from your Finance and Management Accounting to Project management, Client Relationship Management (CRM – see more below), Human Resources, Inventory and Purchasing.

ERP – Enterprise Resource Planning is a system facilitating the flow of information between all business functions, from your Finance and Management Accounting to Project management, Client Relationship Management (CRM – see more below), Human Resources, Inventory and Purchasing.  For many of us, the mere mention of cash basis is not unlike the old “fingernails on a chalkboard” – not something we want to hear. However, cash basis accounting need not be something that is left only to your CPA. Your Deltek Vision system can be set to easily track your transactions and financials on both an accrual basis and on a cash basis with minimal effort.

For many of us, the mere mention of cash basis is not unlike the old “fingernails on a chalkboard” – not something we want to hear. However, cash basis accounting need not be something that is left only to your CPA. Your Deltek Vision system can be set to easily track your transactions and financials on both an accrual basis and on a cash basis with minimal effort.

conduct business in a currency other than US dollars? These and other questions should be addressed during the planning process and will help you determine if multi-company is a good fit your firm.

conduct business in a currency other than US dollars? These and other questions should be addressed during the planning process and will help you determine if multi-company is a good fit your firm.  As we come into the holiday season many of us in accounting face the coming season, not only with the joy of family and friends coming together, but with a sense of impending dread – YEAR END and TAX SEASON are looming – ugh - have another drink.

As we come into the holiday season many of us in accounting face the coming season, not only with the joy of family and friends coming together, but with a sense of impending dread – YEAR END and TAX SEASON are looming – ugh - have another drink. When to run

When to run Try this with a small group of invoices to start until you get the hang of it. Then expand to include all your invoices. This method not only saves you time and money (printing and mailing costs) in producing final invoices, but it also gets your invoice to your client sooner which can reduce your cash cycle days.

Try this with a small group of invoices to start until you get the hang of it. Then expand to include all your invoices. This method not only saves you time and money (printing and mailing costs) in producing final invoices, but it also gets your invoice to your client sooner which can reduce your cash cycle days.