Preparing for 2019 Year-End

Year-End is coming! Don’t let year-end bring you down - create a plan and stick to it. A great way to start is by creating a checklist and calendar. Make sure your calendar includes all year-end deadlines: final AP and Expense payment processing, final timesheets due, and final bank reconciliation are all important items to include. Deltek issues a checklist yearly, and this is an excellent starting point to create the plan for your company. Once issued, it will be available on the Support Center site.

Top Items to Consider Adding to Your Year-End Checklist

- Reconcile all cash accounts – Post all transactions in Deltek Vantagepoint or Vision. Verify your general ledger balances match your bank statements. Make all adjustments as needed.

- Final Invoicing – Process all client invoices for the fiscal year.

- Review outstanding Accounts Receivables – Follow-up with clients who have outstanding accounts receivables beyond 30 days. Send past due statements and/or simply give them a call. Enter the results of your collection efforts in the comments section of Deltek Vantagepoint or Vision Invoice Review. Year-end is an excellent time to collect your outstanding receivables. If you determine there is uncollectable AR, be sure to write those invoices off.

- Review Unbilled detail - Time and expense transactions that cannot be invoiced to clients should be written off at this time.

- Fixed Assets – Fixed Assets are larger purchases that are made throughout the year (i.e. equipment, automobiles, furniture, computers, etc.). This is the time to make sure all fixed assets are reported on the balance sheet if they are still owned. If not, record the sale or disposal of these fixed assets. Additionally, verify the depreciation on your fixed assets as well and make any necessary adjustments.

- Employee Expenses and AP - Verify that all accounts payable vouchers have been recorded in Deltek Vantagepoint or Vision. Make your 401(k), SEP IRA, and Simple IRA contributions have been made, if you have not done so. Try and pay all your vendors and employee expense reports by year-end.

- Notes Payable - Verify notes payable (i.e. loans) amounts on your balance sheet match the statements from your lenders and make all adjustments as needed.

- W-9s – Order 1099 forms as soon as possible. Furthermore, make sure all W-9s from your vendors and/or contractors that have been paid $600 or more to throughout the year are on file. Don’t forget 1099s should be mailed on January 31st. 1099 forms can be purchased from most office supply stores, or you can order them for free from the IRS.

- W-2s – If you run payroll in Deltek Vantagepoint or Vision, order W-2 forms. W-2s should be mailed by January 31st. W-2s can be purchased from most office supply stores.

- Budget for next year - Create your GL budget for 2019.

Communication and Organization is Key to Success

Make sure all in the firm know what their role is for year-end, i.e. when final timesheets and expense reports are due. Put a year-end process in place, create a manual and checklist to use yearly, and you’ll be ahead of the game next year! Please note: Deltek will be issuing year-end updates for Vision 7.6 and Vantagepoint. If you are on 7.5 or older, you must upgrade to a supported version to receive a 2019 year-end update. If you are still on Vision 7.5 or an older version, contact Full Sail Partners if you have questions about upgrading to Vision 7.6.

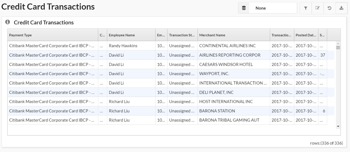

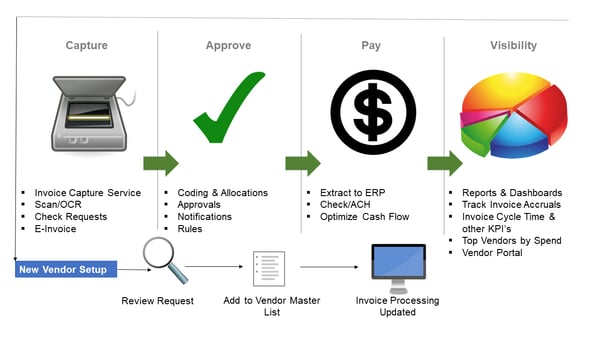

One of the most time-consuming processes for accounting is accounts payable (AP). In fact, the entire process from receiving and reviewing invoices to paying the vendor is riddled with opportunities for errors. To make matters worse, 77% of invoices received by companies are in a manual format such as hard copies, PDFs and emails, and the average cost to process one invoice is $34. There is, however, a way to put an end to these ever-present accounting woes – automate the AP process.

One of the most time-consuming processes for accounting is accounts payable (AP). In fact, the entire process from receiving and reviewing invoices to paying the vendor is riddled with opportunities for errors. To make matters worse, 77% of invoices received by companies are in a manual format such as hard copies, PDFs and emails, and the average cost to process one invoice is $34. There is, however, a way to put an end to these ever-present accounting woes – automate the AP process.

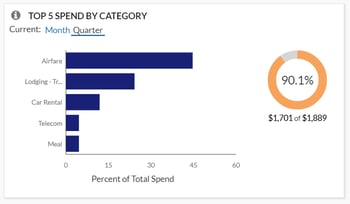

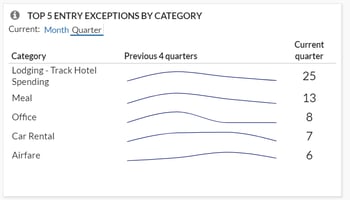

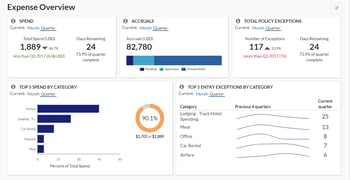

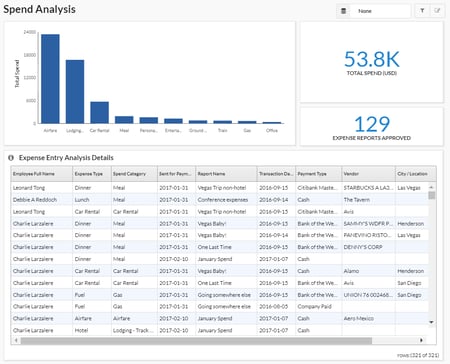

Expense management seems to be a difficult task for accounting personnel at many professional services firms. With a workforce that is constantly on the go, tracking spending and enforcing expense policies can provide a plethora of challenges. What if there was a better way to manage expenses? Let’s see what firms can do to improve the expense management process.

Expense management seems to be a difficult task for accounting personnel at many professional services firms. With a workforce that is constantly on the go, tracking spending and enforcing expense policies can provide a plethora of challenges. What if there was a better way to manage expenses? Let’s see what firms can do to improve the expense management process.

When Deltek for Professional Services (DPS) 2.0 is released, it will have a new name -

When Deltek for Professional Services (DPS) 2.0 is released, it will have a new name -

On May 28th, 2014 the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) jointly issued the Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers. At the end of 2018, the way professional services firms recognize revenue from contracts with customers will be significantly impacted. ASC 606 will require firms to recognize revenue when goods or services are transferred to the customer in an amount that is equivalent to the goods or services delivered at that point. Let’s break this down into layman’s terms.

On May 28th, 2014 the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) jointly issued the Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers. At the end of 2018, the way professional services firms recognize revenue from contracts with customers will be significantly impacted. ASC 606 will require firms to recognize revenue when goods or services are transferred to the customer in an amount that is equivalent to the goods or services delivered at that point. Let’s break this down into layman’s terms.

Financial reports are essential to every organization for providing information about the health of a business to internal stakeholders as well as interested outside parties. For many firms, this is a manual process which requires significant time and resources to collect expense and invoice details, code them to the ledger, and then organize high-level summary information. Your accounting staff shouldn’t be spending their time organizing data, but instead analyzing the data to help your firm make better business decisions.

Financial reports are essential to every organization for providing information about the health of a business to internal stakeholders as well as interested outside parties. For many firms, this is a manual process which requires significant time and resources to collect expense and invoice details, code them to the ledger, and then organize high-level summary information. Your accounting staff shouldn’t be spending their time organizing data, but instead analyzing the data to help your firm make better business decisions.

In almost every business we walk into, AP is the cause of significant, but often overlooked, strain and costs. From sorting through emailed or paper invoices and tracking checks to manually entering accounting information often requiring corrections, these tasks are huge time consumers. Do you know how many people are managing this in your business, and how many hours they spend each week/month? Think about what else they could be doing with this time and how much money could be saved.

In almost every business we walk into, AP is the cause of significant, but often overlooked, strain and costs. From sorting through emailed or paper invoices and tracking checks to manually entering accounting information often requiring corrections, these tasks are huge time consumers. Do you know how many people are managing this in your business, and how many hours they spend each week/month? Think about what else they could be doing with this time and how much money could be saved.

It is amazing that so many people aren’t even aware of the numerous benefits of using the Deltek Vision Payroll module. For starters, the Payroll module in Vision is a robust application that gives you control over your payroll process that you otherwise wouldn’t have if you used an outside payroll company. It allows you to meet the increasingly complex regulatory requirements by defining taxable wages based on any withholding codes that you create. You can also define how other pay wages impact a withholding calculation. All of this can be done from Payroll Withholding Setup.

It is amazing that so many people aren’t even aware of the numerous benefits of using the Deltek Vision Payroll module. For starters, the Payroll module in Vision is a robust application that gives you control over your payroll process that you otherwise wouldn’t have if you used an outside payroll company. It allows you to meet the increasingly complex regulatory requirements by defining taxable wages based on any withholding codes that you create. You can also define how other pay wages impact a withholding calculation. All of this can be done from Payroll Withholding Setup.