Why Your Firm Should Be Using Earned Value Management

For project-based firms, measuring current firm performance is the most significant indicator of future firm performance. Furthermore, by using trend data, firms can forecast cost and schedule variances in the early stage of a project. A preferred method by project managers to factor this trend data is the earned value management technique.

For project-based firms, measuring current firm performance is the most significant indicator of future firm performance. Furthermore, by using trend data, firms can forecast cost and schedule variances in the early stage of a project. A preferred method by project managers to factor this trend data is the earned value management technique.

Using Earned Value Management

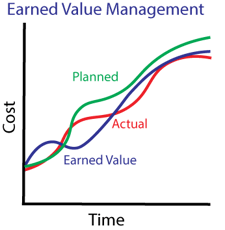

Earned value management allows firms to evaluate cost and schedule variances in both dollars and percentages on projects. These factors are derived by considering planned value, actual cost and earned value over time.

A common way of looking at earned value is by using both the financial percent complete job to date (JTD) and the estimate too complete (ETC) by using the formula, JTD/(JTD + ETC) and the project managers reported physical percent complete. These two factors when equated provide a quick and easy comparison. For example, the financial percent complete on construction documents may be at 75% when the reported percent complete on construction documents is 50%. There are several possible explanations for these variances, such as:

- There were many revisions that were client driven and not in scope

- The complexity of the work was under estimated

- We have just been very inefficient

Keep in mind, there are a number of other scenarios that can also explain these factors as well.

Factoring Earned Value Management

Getting the information above is actually simple. It requires holding project managers to a high level of accountability. Project managers need to evaluate the amount of hours budgeted, hours burned (JTD), and the effort required to finish the scope of work (ETC).

As a result, this will produce the financial percent complete. Project managers then need to record where the project is from a physical percent complete, which should tie to progress on the project schedule.

Much like a crossover episode of two TV shows, this is where EVM crosses over with a previous blog about FASB 606. EVM will ultimately meet the requirements that in turn will keep the accounting team compliant with FASB 606.

Enter Deltek Vision

The Resource Planning module in Deltek Vision addresses EVM by:

- Allowing the financial percent complete to be calculated

- Providing a physical percent complete plan in the form of an EV%

- A default report in the Resource Planning module known as the Earned Value Chart, which represents the S Curve

By maintaining a project plan in the Resource Planning module, firms can be successful in developing a project report that shows cost and schedule variances in both the dollars and percent (CV, SV, CPI and SPI). If your firm has a benchmark or standard range, you can then compare the actual to that standard to identify anomalies in your projects performance.

The title of this blog is, “Why Your Firm Should Use Earned Value Management” and the answers are:

- It’s an industry standard and proven method for project management and project accounting

- It’s a common language among project managers across industries

- It provides quick visibility into a projects performance

- It brings firms closer to compliance with FASB 606

Learn more about Michael Kessler and his more than 30 years of experience of working in and around project-based accounting here.

Deltek is at it again! With the introduction of Deltek Vision version 7.6, professional services firms are now able to streamline their credit card processes thanks to several new key enhancements. Providing some background, the introduction of credit cards was one of the many improvements to Vision in version 7.3. When 7.3 was released, firms gained efficiency with employee expense reporting as employees could import charges from the credit card company. This feature allowed employees to associate those charges within their expense reports. Now, based on user feedback, credit card functionality has been expanded.

Deltek is at it again! With the introduction of Deltek Vision version 7.6, professional services firms are now able to streamline their credit card processes thanks to several new key enhancements. Providing some background, the introduction of credit cards was one of the many improvements to Vision in version 7.3. When 7.3 was released, firms gained efficiency with employee expense reporting as employees could import charges from the credit card company. This feature allowed employees to associate those charges within their expense reports. Now, based on user feedback, credit card functionality has been expanded.

Full Sail Partners today announced it joined the Concur Solution Provider program and can now refer clients, including those using Deltek, to Concur, the leading provider of spend management solutions and services.

Full Sail Partners today announced it joined the Concur Solution Provider program and can now refer clients, including those using Deltek, to Concur, the leading provider of spend management solutions and services.

I don’t know anyone that actually enjoys completing their expense report. The process is arduous, and steals valuable time from your already hectic day. The fact is, if you want to get reimbursed for a company expenditure, you have to take the time to complete your expense report. No ifs ands or buts about it. Luckily, Blackbox’s Deltek Vision and Concur Integration eliminates this pain staking process for your employees and frees them up to concentrate on client-focused, billable work.

I don’t know anyone that actually enjoys completing their expense report. The process is arduous, and steals valuable time from your already hectic day. The fact is, if you want to get reimbursed for a company expenditure, you have to take the time to complete your expense report. No ifs ands or buts about it. Luckily, Blackbox’s Deltek Vision and Concur Integration eliminates this pain staking process for your employees and frees them up to concentrate on client-focused, billable work.

Our first inclination when the new FASB 606 was announced was this wouldn’t impact many of our Deltek Vision clients. But after more insight, we recognize this has a tremendous impact on our clients. The rule states applicability to ALL entities that deliver goods or services. Though many believe that GAAP, FASB, SOX and other guidelines are good rules to follow regardless of any statutory relevance, the reality is if we are not being overseen we tend to be somewhat lax in compliance.

Our first inclination when the new FASB 606 was announced was this wouldn’t impact many of our Deltek Vision clients. But after more insight, we recognize this has a tremendous impact on our clients. The rule states applicability to ALL entities that deliver goods or services. Though many believe that GAAP, FASB, SOX and other guidelines are good rules to follow regardless of any statutory relevance, the reality is if we are not being overseen we tend to be somewhat lax in compliance. If someone were to ask you what do you like least about your job, what would you say? Assuming you like your boss, your environment and co-workers, there is still always a task that you just wish you didn’t have to do. For me, it is my expenses. You would think, getting reimbursed would be motivation in itself. Yes, at some point it absolutely is. It has gotten much easier now that I can take a picture of my receipts and quickly upload through my Deltek Vision Touch application with my phone. However, I still have to fill out the details which takes time. Time I don’t always have. What if I told you it could get even easier? I was then introduced to the Concur expense solution.

If someone were to ask you what do you like least about your job, what would you say? Assuming you like your boss, your environment and co-workers, there is still always a task that you just wish you didn’t have to do. For me, it is my expenses. You would think, getting reimbursed would be motivation in itself. Yes, at some point it absolutely is. It has gotten much easier now that I can take a picture of my receipts and quickly upload through my Deltek Vision Touch application with my phone. However, I still have to fill out the details which takes time. Time I don’t always have. What if I told you it could get even easier? I was then introduced to the Concur expense solution.

For project-based firms, timesheets are essential to ensure that an employee’s time is reflected to a specific project. I’m sure you already knew this, but do you manage timesheets correctly in Deltek Vision? Here are some facts and best practices for different scenarios to help you better manage timesheets in Deltek Vision.

For project-based firms, timesheets are essential to ensure that an employee’s time is reflected to a specific project. I’m sure you already knew this, but do you manage timesheets correctly in Deltek Vision? Here are some facts and best practices for different scenarios to help you better manage timesheets in Deltek Vision.

Creativity, when used in the accounting world, is usually considered a “no-no”. However, I am not talking about misrepresenting the state of affairs. In fact, I am talking about the exact opposite - providing the client exactly what you told them to expect at the beginning of the proposal process. Let’s take a look at how setting client expectations early can improve your firm’s cash flow.

Creativity, when used in the accounting world, is usually considered a “no-no”. However, I am not talking about misrepresenting the state of affairs. In fact, I am talking about the exact opposite - providing the client exactly what you told them to expect at the beginning of the proposal process. Let’s take a look at how setting client expectations early can improve your firm’s cash flow.  Most firms that I work with utilize independent contractors to supplement their workforce. This isn’t a blog about “walks and talks like an employee, must be an employee.” For that, I recommend a good labor attorney. However, what I am going to clue you in on is about the proper way to track and account for independent contractor’s time in Deltek Vision.

Most firms that I work with utilize independent contractors to supplement their workforce. This isn’t a blog about “walks and talks like an employee, must be an employee.” For that, I recommend a good labor attorney. However, what I am going to clue you in on is about the proper way to track and account for independent contractor’s time in Deltek Vision.

You know you have spent your whole workweek devoted to a specific project, but you’re only showing 35 hours being billed/charged to the project. Where did the value of those 5 hours go? In many cases, these missing hours can be attributed to non-billable labor, and many AEC firms overlook the importance of documenting how this time is spent. However, accurately accounting for non-billable labor is extremely important to track accurate project performance.

You know you have spent your whole workweek devoted to a specific project, but you’re only showing 35 hours being billed/charged to the project. Where did the value of those 5 hours go? In many cases, these missing hours can be attributed to non-billable labor, and many AEC firms overlook the importance of documenting how this time is spent. However, accurately accounting for non-billable labor is extremely important to track accurate project performance.