What is the Difference Between Project Backlog and Project Forecasting?

If you're neck-deep in the world of professional services consulting, you know that staying on top of your financial game isn't just about counting beans; it's about smart planning and even smarter execution. That's where getting cozy with project backlog and project forecasting comes into play. They're like the dynamic duo of the project management world, and if you're in charge of the purse strings or the big decisions at your professional services firm, you'll want to give these two the attention they deserve.

If you're neck-deep in the world of professional services consulting, you know that staying on top of your financial game isn't just about counting beans; it's about smart planning and even smarter execution. That's where getting cozy with project backlog and project forecasting comes into play. They're like the dynamic duo of the project management world, and if you're in charge of the purse strings or the big decisions at your professional services firm, you'll want to give these two the attention they deserve.

So first off, let’s break each of them down:

- Project Backlog: This is your bread and butter—it's all the work you've already won but haven't done yet. Think of it as your safety net; it's work that you can bank on in the short term. And it's a gold star for your marketing or business development team, too, because it means they've been doing something right. But here's the kicker: it's not just about having a backlog; it's what you do with it. Manage it well, and you're looking at a smooth road to profit town. Mismanage it, and well, it's a bumpy ride.

- Project Forecasting: Forecasting, on the other hand, is your crystal ball. It's a bit more elusive, a cocktail of educated guesses and wishful thinking. The business development and marketing folks have their ear on the ground, listening for the rumble of potential projects. They're not sure bets like your backlog, but with a savvy mix of hope and pragmatism, they plot out what could be coming down the pipeline.

Now, when you put backlog and forecasting together, you get a killer combo that gives you the full picture: cash flow in the immediate future and what your workload might look like down the line.

Leveraging Project Backlog and Project Forecasting for Optimal Performance

Mastering your backlog and forecasting is crucial for various roles within your professional services firm:

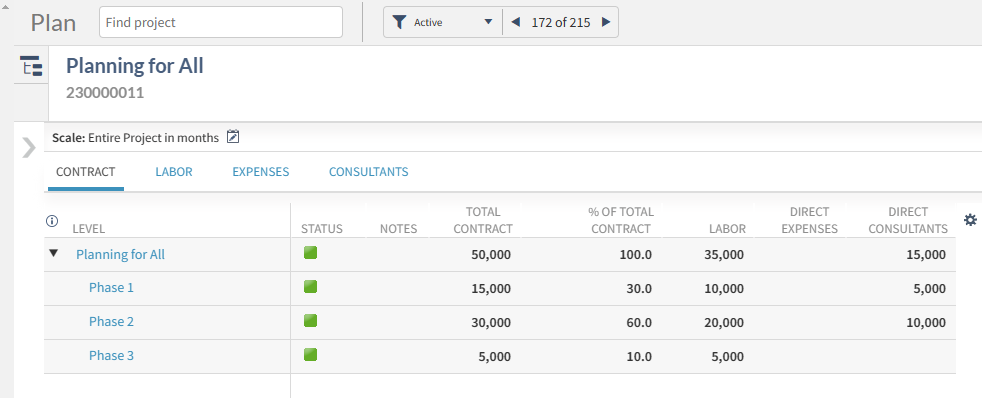

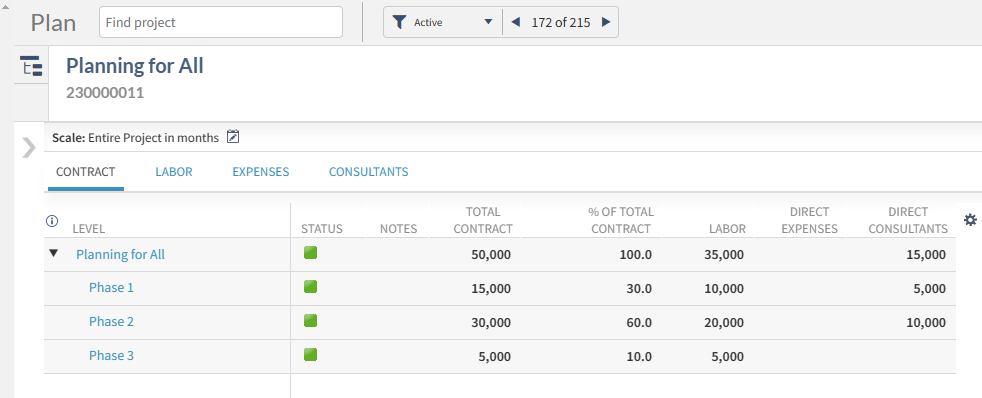

- For Project Managers: Clear visibility into the project backlog means you can allocate resources effectively, prevent scheduling conflicts, and maintain optimal workflow. Deltek Vantagepoint, for instance, can provide the granular insight you need to ensure that projects are adequately staffed and that timelines are met, minimizing the risk of underutilization or bottlenecks.

- For Business Developers: Your backlog is your success story in numbers—it's proof of performance that you can showcase to potential clients. Knowing what's in the pipeline helps you strategize new business pitches and align offerings with market demand. When it comes to forecasting, having a robust prediction tool allows you to prioritize pursuits based on the likelihood of project acquisition and future revenue potential. Deltek Vantagepoint's pipeline management tools ensure you're targeting the right opportunities at the right time.

- For Marketing Teams: Backlog data informs you when to double down on lead generation efforts or refine targeting strategies. It's a barometer for market engagement, guiding you on when to accelerate awareness campaigns or capitalize on high demand. With Vantagepoint Marketing Campaigns, you can gauge campaign impacts on your forecast and backlog, enabling data-driven marketing decisions.

- For Financial Controllers: Backlog and forecast reports are not just numbers; they're predictors of your firm's financial health. They validate if revenue projections are on track and highlight discrepancies that need attention. The accurate and detailed reports from Deltek Vantagepoint can assist in adjusting financial strategies, whether it’s scaling operations or tightening budget controls.

By integrating tools like Deltek Vantagepoint to manage backlog and forecast, every role from project management to business development can benefit from increased visibility, better decision-making capabilities, and a stronger strategy for sustainable growth.

How to Implement a Backlog and Forecast Strategy

It is not complicated. The project backlog and project forecasting process needs only to provide a standard tool for company-wide project planning and review. Use the following three steps to initiate a project backlog and project forecasting process.

Step 1: Begin with a Detailed ‘Bottom-up’ Forecast

Project managers, your weekly routine should include a thorough review of your project backlog. Prioritize the projects with more than a 60% likelihood of commencement. Allocate your team members, estimate the required hours, and plan out the next eight weeks. It’s a practical exercise in resource allocation and workload management.

The benefits?

- You'll balance team capacity against project demands, considering downtime for vacations or training.

- You’ll monitor project progress and ensure you're on track with milestones.

- You’ll forecast potential revenue by aligning upcoming work hours with billing rates.

Step 2: Consolidate Insights at a Management Level

Once project managers provide their data, it's time for leadership to analyze it. This aggregation step allows for spotting trends, potential resource sharing, future revenue projections, and early detection of budgetary issues or hiring needs.

Step 3: Validate Your Forecast

Compare your projected outcomes with the actual data. This step verifies the accuracy of your forecasting and provides a basis for adjustment and improvement.

With Deltek Vantagepoint, you can streamline these processes, enabling your leadership, project management, finance, business development, and/or marketing teams to detect trends, identify efficiency opportunities, and enhance decision-making with data-driven dashboards.

This approach is about more than just numbers; it's about using data to tell the story of your professional services firm’s trajectory, making informed decisions, and navigating your firm's path forward with confidence. Let’s get started on making backlog and forecasting integral parts of your strategic toolkit.

Ready to Navigate Your Firm's Future with Clarity?

Chart a course for success with Full Sail Partners. Our expertise in working with professional services firms and Deltek Vantagepoint positions your firm to master both project backlog and forecasting, transforming data into actionable insights. Connect with us to see how we can help you optimize your operations and elevate your project management strategy.

Congratulations! Your firm just won the largest project in its history and it’s time to celebrate, or is it? Unfortunately, winning the big project doesn’t guarantee success and big profits. For project-based firms, project management is synonymous with profit management, but many projects start in the red making it nearly impossible to make a profit. Here’s a look at some common pitfalls project-based firms face before they ever start a project.

Congratulations! Your firm just won the largest project in its history and it’s time to celebrate, or is it? Unfortunately, winning the big project doesn’t guarantee success and big profits. For project-based firms, project management is synonymous with profit management, but many projects start in the red making it nearly impossible to make a profit. Here’s a look at some common pitfalls project-based firms face before they ever start a project.

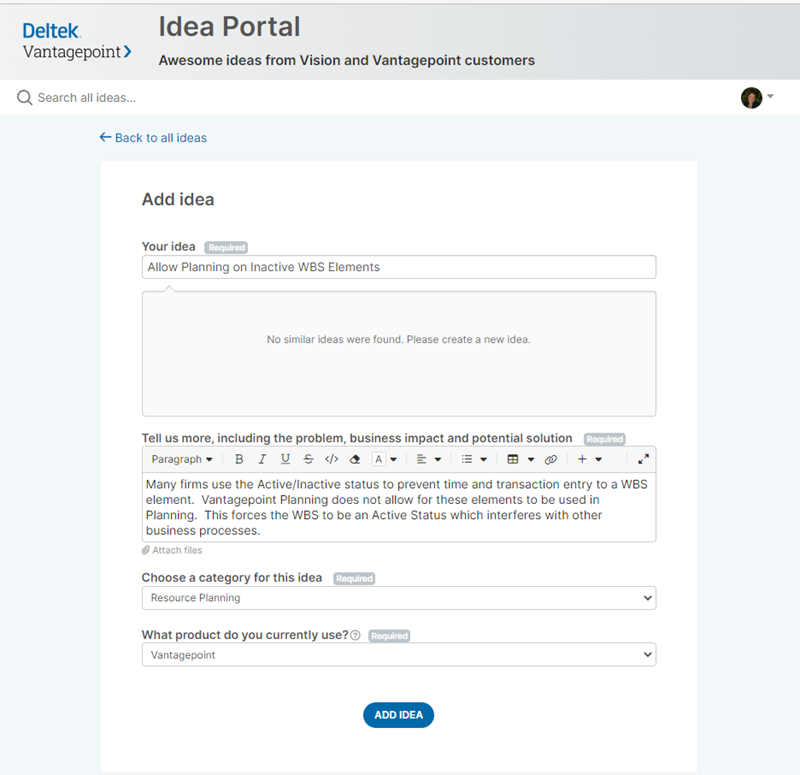

So what are the tools to allow you to be an effective, involved leader of the management of change process? Quite simply, an executive dashboard in a technology solution from a company like Full Sail Partners who can customize software for your change management project. Dashboards, like the one pictured here, can

So what are the tools to allow you to be an effective, involved leader of the management of change process? Quite simply, an executive dashboard in a technology solution from a company like Full Sail Partners who can customize software for your change management project. Dashboards, like the one pictured here, can

In soccer, while the right players, good equipment, and positive fan support are unquestionably important parts of the team’s success, the keystone to an effective soccer team is, in fact, the coach. The coach’s job is to balance each player’s strengths against the combined team’s goal of winning.

In soccer, while the right players, good equipment, and positive fan support are unquestionably important parts of the team’s success, the keystone to an effective soccer team is, in fact, the coach. The coach’s job is to balance each player’s strengths against the combined team’s goal of winning. Choosing the wrong ERP consultant or software solution can lead to significant issues penalizing you in dollars, time and public relations. Following are only two examples of many instances of what happens when ERP implementations fail:

Choosing the wrong ERP consultant or software solution can lead to significant issues penalizing you in dollars, time and public relations. Following are only two examples of many instances of what happens when ERP implementations fail:

The weather this winter has played havoc with the daily lives of millions of individuals, as well as countless businesses.

The weather this winter has played havoc with the daily lives of millions of individuals, as well as countless businesses.

For most professional services firms, planning for growth is a natural part of business. There are different strategies for doing so, and choosing the best one depends on your ultimate growth objectives. But whatever your goals, understanding how your growth plan affects your cash flow plan is essential to achieving the results you seek.

For most professional services firms, planning for growth is a natural part of business. There are different strategies for doing so, and choosing the best one depends on your ultimate growth objectives. But whatever your goals, understanding how your growth plan affects your cash flow plan is essential to achieving the results you seek.

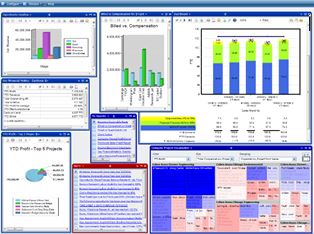

Of all the metrics that professional services firms can track, two of the most important are utilization and realization. These are different, but related ways of measuring employee productivity and profitability. Both can be measured with a high degree of accuracy — and made visible to management — using software.

Of all the metrics that professional services firms can track, two of the most important are utilization and realization. These are different, but related ways of measuring employee productivity and profitability. Both can be measured with a high degree of accuracy — and made visible to management — using software.